Cibola EA MT4 V1.9 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

Cibola EA MT4 combines Martingale automation with intelligent postponement analysis and deceleration controls. Proven 89% win rate with systematic risk management for MT4.

Introducing Cibola EA

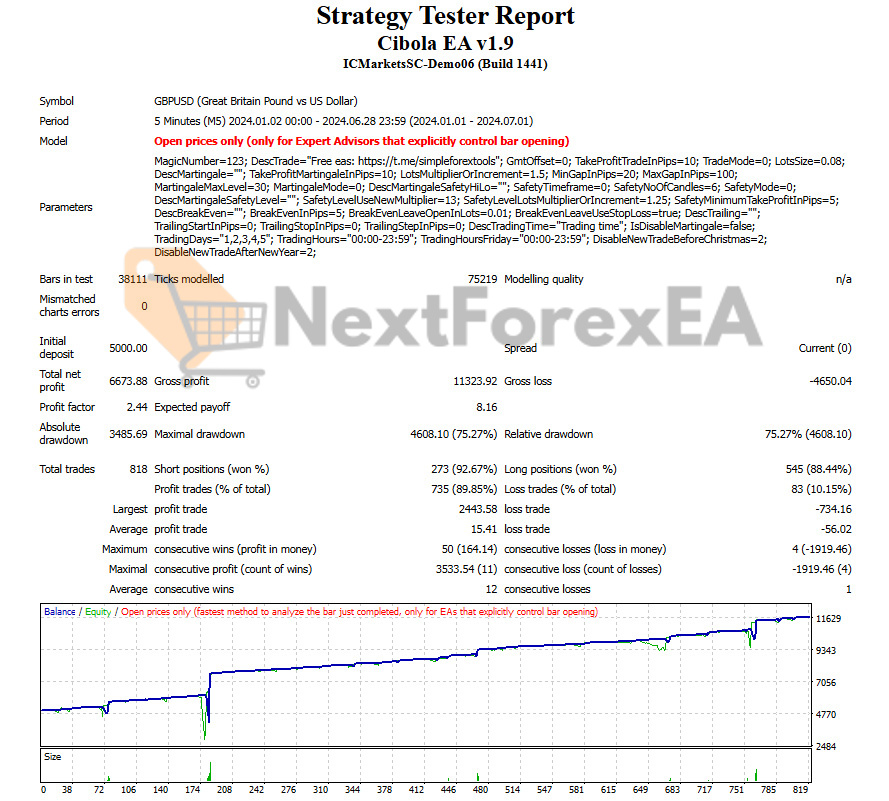

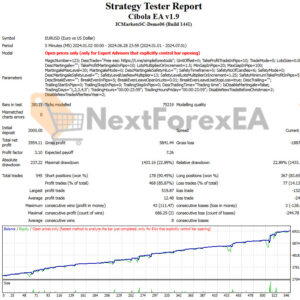

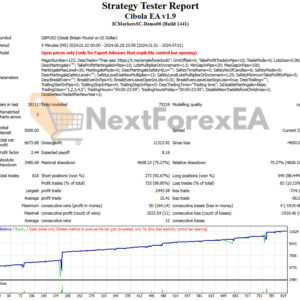

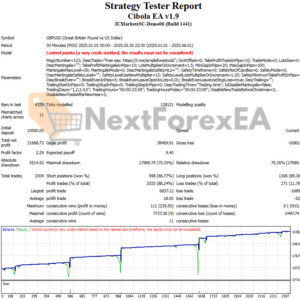

Cibola EA revolutionizes traditional Martingale systems by incorporating smart postponement analysis and automatic deceleration controls to reduce risk exposure during unfavorable market conditions. Backtesting demonstrates 133% profit growth over 6 months with 2.44 profit factor on GBPUSD, accompanied by 75.27% maximum drawdown reflecting the strategy’s high-risk nature.

Key Findings

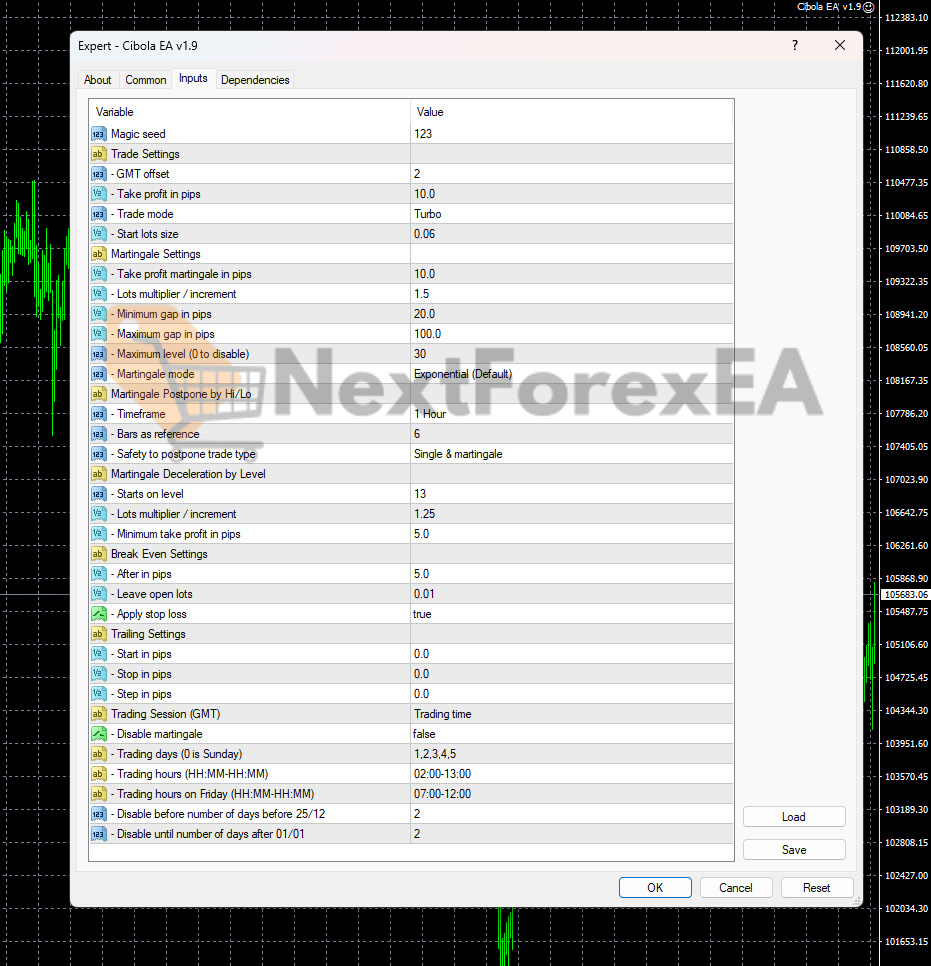

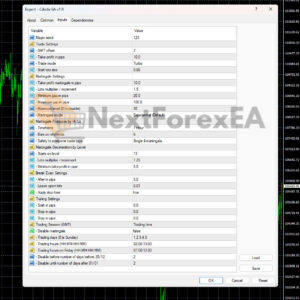

• System Overview: Sophisticated MT4 automation combining high-frequency scalping with up to 30-level Martingale recovery, featuring H1 postponement analysis and progressive risk reduction mechanisms

• Core Strategy: Initiates with 10-pip take profit scalping trades, then employs 1.5x exponential lot scaling at configurable 20-100 pip intervals. Smart postponement examines 6-bar H1 patterns to delay entries during trending conditions, while deceleration phase reduces multiplier to 1.25x beyond level 13 for exposure control

• Strategic Advantages with Limitations:

- Eliminates emotional interference through complete automation, but requires accepting substantial drawdown periods exceeding 70%

- Delivers 89.85% win rate providing regular income flow, though single adverse events can negate weeks of accumulated profits

- Postponement logic improves entry timing over basic grid systems, but cannot prevent losses during extended trending markets

- Break-even and session controls enhance risk management, though may limit profit opportunities in volatile conditions

• Documented Performance: GBPUSD M5 testing reveals 133% returns across 818 trades with 2.44 profit factor, but 75.27% maximum drawdown demonstrates extreme capital requirements for strategy survival

• Critical Risk Factor: Extended trending markets can trigger sequential recovery levels leading to catastrophic account damage despite built-in safety mechanisms

Recommendations for using Cibola EA

• Platform Requirement: MetaTrader 4 (MT4) exclusive compatibility

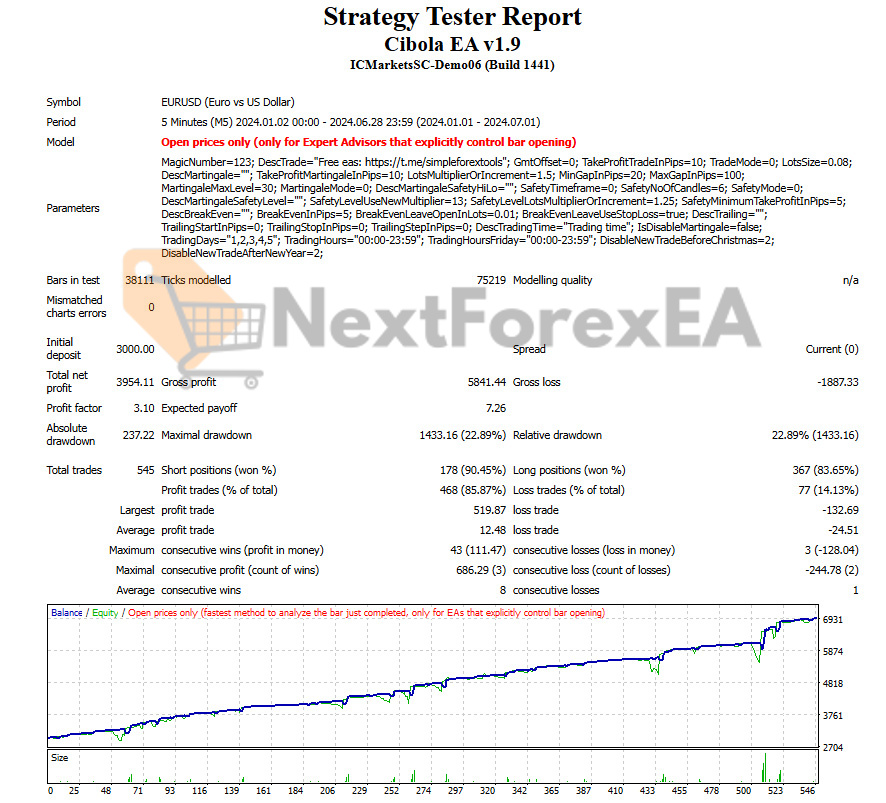

• Currency Selection: GBPUSD extensively validated through backtesting – EURUSD secondary recommendation with comparable volatility characteristics

• Account Specification: ECN execution preferred for spread minimization essential to scalping profitability

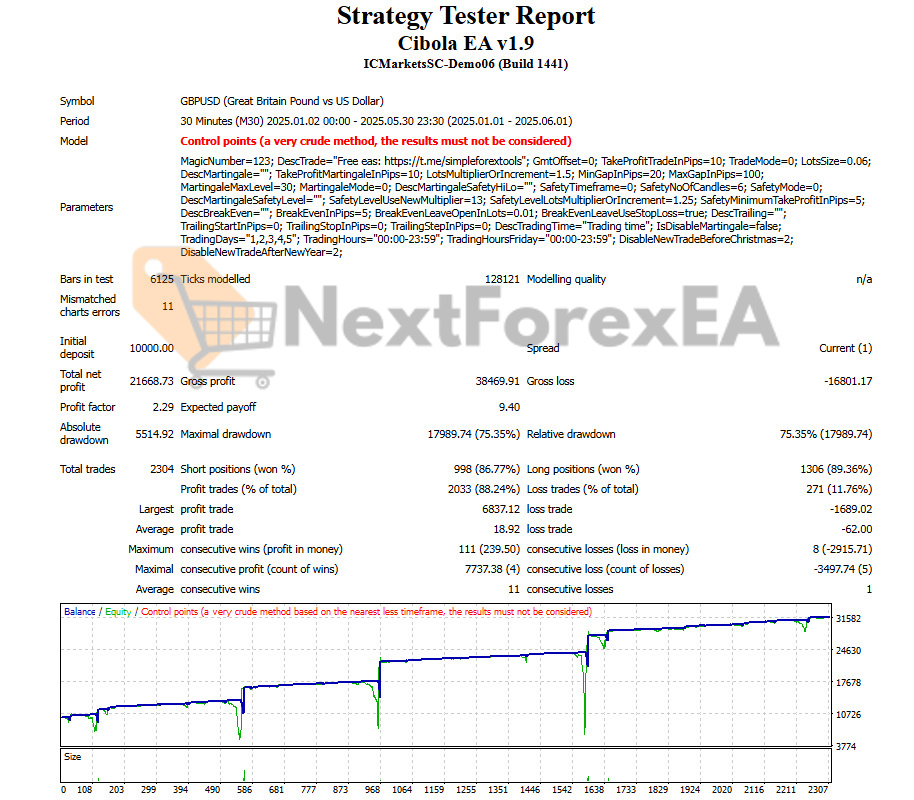

• Optimal Timeframe: M5 provides maximum signal frequency – M30 alternative for reduced trade volume

• Trading Schedule: Monday-Friday activation with session filtering to avoid weekend gaps and high-impact news releases

• Leverage Configuration: 1:100 minimum threshold for adequate margin maintenance, though higher ratios exponentially increase both return potential and catastrophic loss risk

• Capital Foundation: $500 minimum advertised, but $5000+ strongly recommended to withstand documented 75% drawdown scenarios without account termination

Review of Cibola EA

Cibola EA excels at automated Martingale execution with intelligent risk controls and consistent 89% win rates, providing systematic profit generation superior to manual trading. The extreme 75% drawdown potential demands substantial capital reserves and professional risk management expertise for long-term viability.

Key Performance Metrics:

• GBPUSD 6-month backtest: 133% account growth with 2.44 profit factor but 75.27% peak drawdown

• 818 trade execution: 89.85% success rate demonstrating strategy effectiveness with severe risk exposure

• Risk-reward profile: $11,323 gross profit versus $4,650 gross loss showing positive mathematical expectancy

Is Cibola EA the Right Choice For You?

• Intelligent Automation: Postponement and deceleration features provide superior risk management compared to basic recovery systems, but require extensive backtesting and parameter optimization for different market conditions

• High-Probability Trading: 89% win rate generates more consistent cash flow than traditional trend-following approaches, though demands psychological preparation for inevitable significant drawdown periods

• Advanced Risk Controls: Multi-layer safety mechanisms offer better protection than standard grid EAs, but cannot eliminate fundamental Martingale vulnerability to sustained directional markets

• Transparent Performance: Comprehensive backtest documentation provides verifiable results unlike theoretical marketing promises, though live execution may encounter slippage and broker-related challenges

• Professional-Grade Complexity: Sophisticated parameter management and recovery logic suit experienced traders better than simplified alternatives, but require deep understanding of risk-reward mathematics and proper capitalization

Final Verdict

Cibola EA delivers advanced Martingale automation with proven profitability and intelligent safety features, but requires substantial capital reserves and professional risk management skills. Excellent choice for experienced high-risk traders; completely unsuitable for beginners or conservative investors.

Cibola EA MT4 Download Contents:

- Link download experts:

- Cibola EA MT4.ex4

- Presets:

- Cibola.set

Be the first to review “Cibola EA MT4 V1.9 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FX P2R ViP VERSION EA 2023 MT4 unlimited- low DD and High Profit EA (working Build 1420)

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.