Dow Dax Forex EA MT4 V1.1 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

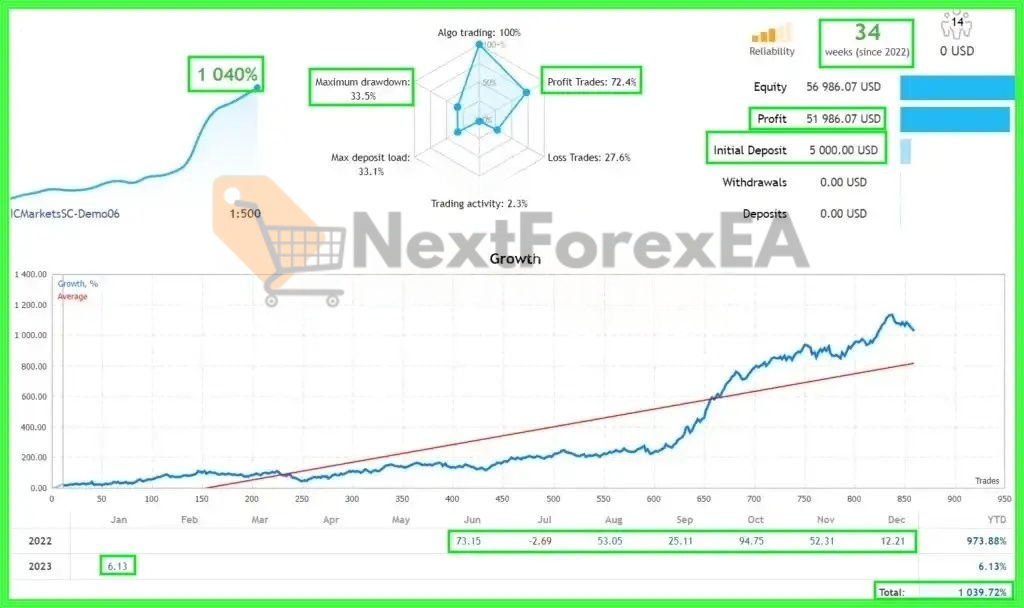

Dow Dax Forex EA MT4: Specialized index breakout automation for US30 & GER30. Live verified 1,040% growth, 72.4% win rate. MT4 prop firm compatible.

Introducing Dow Dax Forex EA MT4

Dow Dax Forex EA MT4 provides automated box breakout trading tailored for volatile index markets, specifically targeting US30 and GER30 with prop firm-compliant risk management protocols. Live performance demonstrates 1,040% growth over 34 weeks with 72.4% win rate, accompanied by 33.5% maximum drawdown requiring careful risk assessment before deployment.

Key Findings

• Operational Framework: Session-based breakout detection system operating during user-defined hours (10:00-17:00 default), executing trades when price breaks consolidation ranges with predetermined entry offsets and comprehensive risk management protocols

• Core Strategy Mechanics: Time-filtered consolidation identification followed by directional breakout execution using pending order placement. Key components include range size limitations, entry confirmation through offset triggers, fixed stop loss protection, trailing stop activation, and break-even adjustment mechanisms without martingale recovery

• Strategic Advantages with Limitations:

- Controlled Risk Exposure: Fixed lot sizing and mandatory stop losses provide consistent risk parameters, though conservative approach may underutilize account potential during strong trending phases

- Market Timing Precision: Session-based operation targets high-probability volatility periods reducing false signals, but restricts trading opportunities to predetermined windows

- Index Optimization: Calibrated for high-volatility instruments offering enhanced profit potential per trade, though exposing traders to wider spreads, gap risk, and index-specific market behaviors

- Automation Benefits: Eliminates emotional trading decisions and manual monitoring requirements, requiring discipline to avoid intervention during natural drawdown cycles

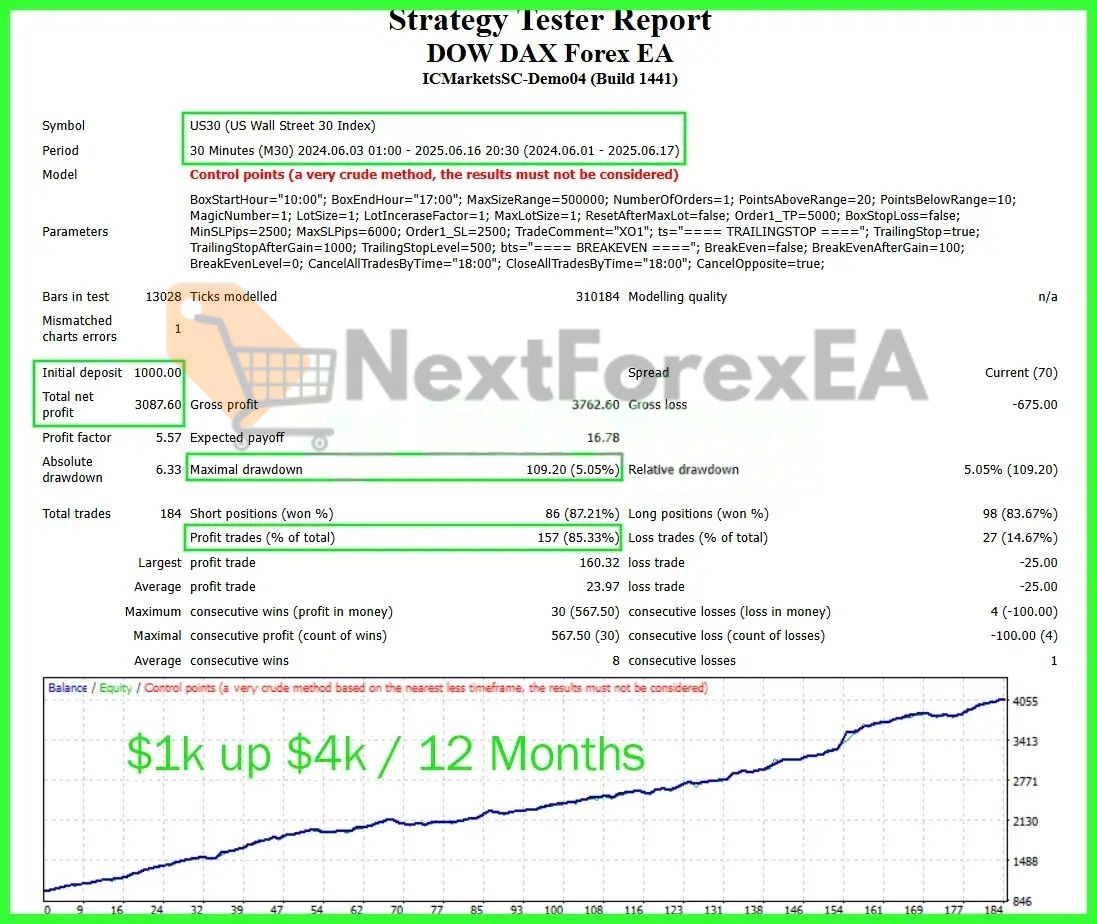

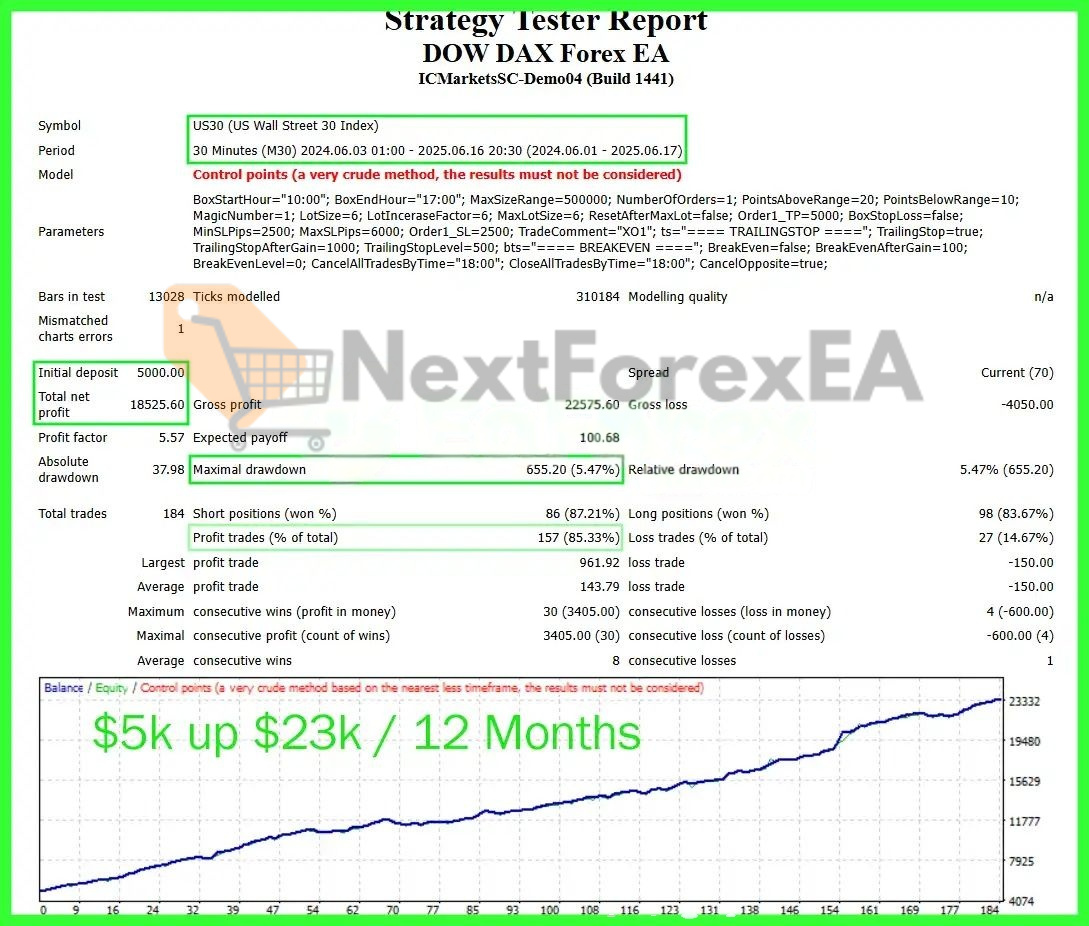

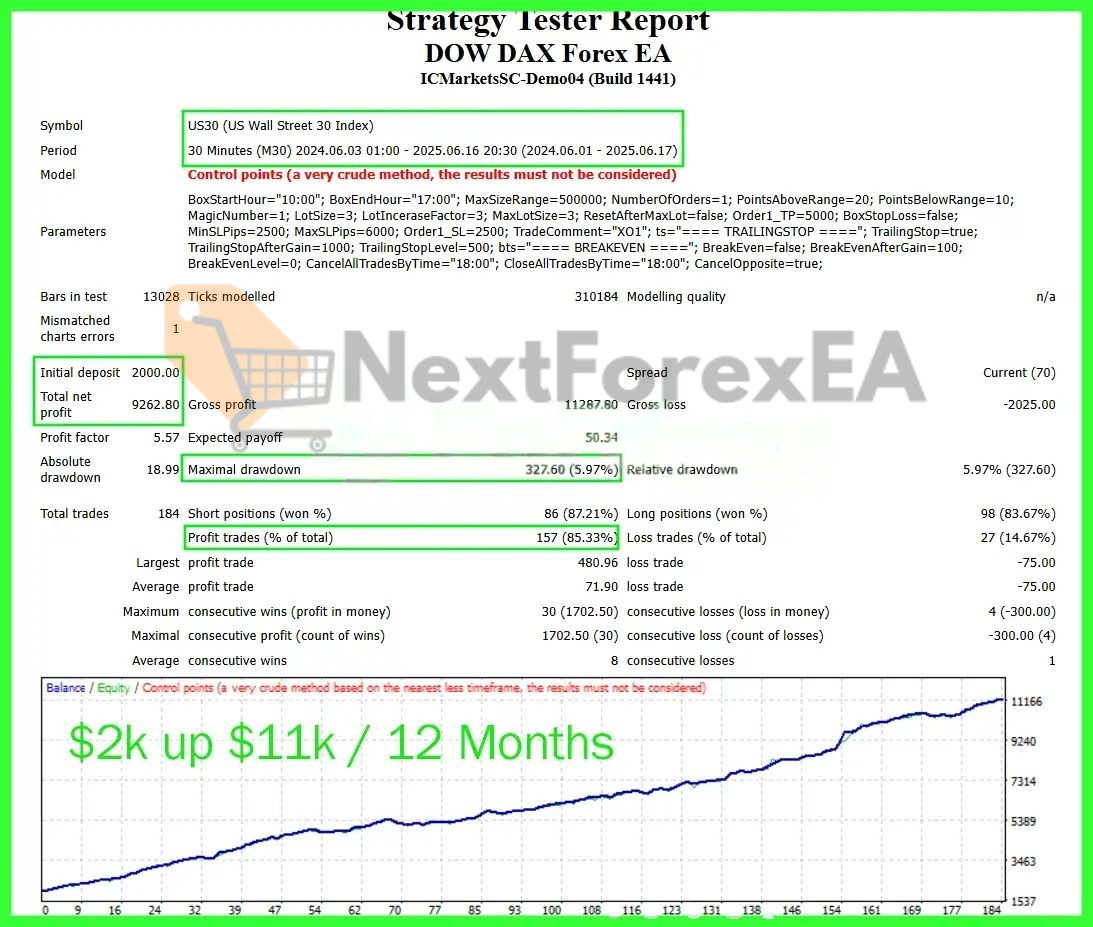

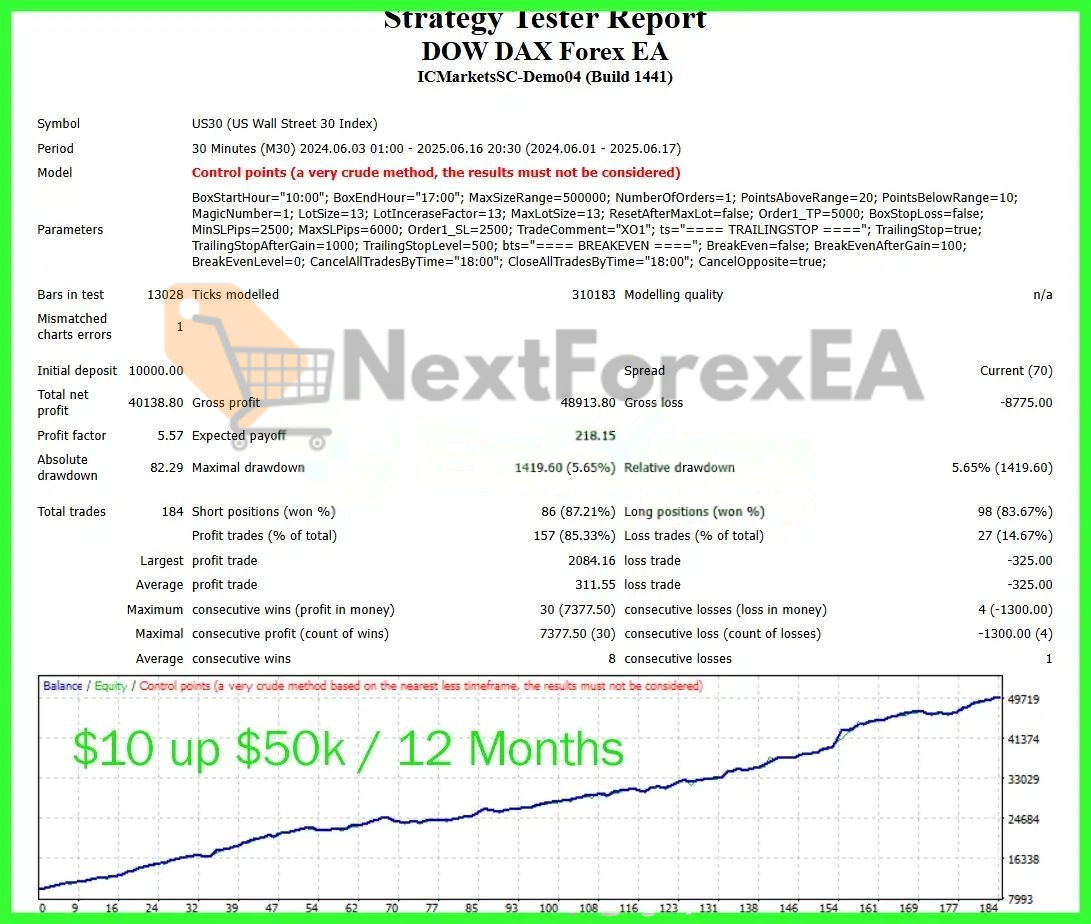

• Performance Documentation: Live signal achieved 1,040% growth with 72.4% win rate over 34 weeks, maximum drawdown 33.5%. Backtests indicate 85.33% win rate with 5.57 profit factor across 184 trades, however testing methodology explicitly deemed unreliable – live results provide more accurate performance baseline

• Risk Considerations: Strategy vulnerability to ranging market conditions generating false breakouts, high sensitivity to news-driven volatility spikes, dependency on broker execution quality during breakout scenarios, and significant variance between backtest (6%) and live drawdown (33.5%) levels

Recommendations for using Dow Dax Forex EA MT4

• Platform Requirement: MetaTrader 4 (MT4) exclusive compatibility

• Target Instruments: US30 (Dow Jones) and GER30 (DAX) indices – index trading involves higher volatility and different risk characteristics than forex pairs

• Account Configuration: ECN account types recommended for optimal execution during breakout events

• Chart Setup: M30 (30-minute) timeframe as tested and optimized configuration

• Trading Schedule: 10:00-17:00 session window during active market periods, adjustable for different time zones

• Leverage Considerations: 1:500 used in live demonstration – high leverage magnifies both profit potential and loss exposure, position sizing critical

• Capital Planning: $5,000 minimum deposit based on live example, $10,000+ recommended considering 33.5% maximum drawdown for sustainable operation through adverse market conditions

Review of Dow Dax Forex EA MT4

Dow Dax Forex EA MT4 delivers specialized index breakout automation with substantial live performance validation showing 1,040% growth and 72.4% win rate, requiring tolerance for significant drawdown periods reaching 33.5%. Best suited for experienced index traders and prop firm participants comfortable with volatility-based strategies and patient capital management.

Live Trading Validation:

• 1,040% account growth over 34-week operational period

• 72.4% win rate across 950+ completed trades

• 33.5% maximum drawdown demonstrating real-world volatility exposure

• 100% algorithmic execution maintaining strategy discipline

Backtest Reference:

• 85.33% win rate with 5.57 profit factor across 184 test trades

• 5-6% backtest drawdown versus 33.5% live performance gap

• Testing methodology limitations explicitly acknowledged

• Results provide strategic framework rather than performance guarantee

Is Dow Dax Forex EA MT4 the Right Choice For You?

• Index Market Specialization: Purpose-built for high-volatility instruments delivering superior profit potential compared to generic forex automation, though requiring familiarity with index trading mechanics including overnight gaps, rollover procedures, and enhanced spread considerations

• Performance Validation: Live trading results offer concrete strategy verification beyond theoretical backtests, but substantial drawdown periods demand psychological resilience and sufficient capital buffer for sustained operation

• Risk Management Philosophy: Non-martingale approach with transparent risk parameters aligns with professional trading standards and prop firm requirements, though conservative position sizing may limit profit acceleration during extended trending markets

• Operational Automation: Complete session-based trading automation eliminates manual chart analysis and emotional decision-making during high-stress periods, but strategy remains inactive outside defined trading windows potentially missing opportunities

• Strategic Transparency: Clear risk parameters and fixed position sizing provide predictable exposure levels compared to variable or opaque risk management systems, though disciplined approach may sacrifice maximum profit potential for consistency

Final Verdict

Dow Dax Forex EA MT4 provides validated index breakout automation with proven live performance, requiring substantial drawdown tolerance and index trading expertise. Ideal for prop firm traders and experienced volatility specialists; inappropriate for conservative traders or those preferring diversified forex strategies.

Dow Dax Forex EA MT4 Download Contents:

- Link download experts:

- Dow Dax Forex EA MT4.ex4

- Presets:

- US30.set

Be the first to review “Dow Dax Forex EA MT4 V1.1 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FX P2R ViP VERSION EA 2023 MT4 unlimited- low DD and High Profit EA (working Build 1420)

Reviews

There are no reviews yet.