Elise EA Source Code MQ4 & MQ5

$2,000.00 Original price was: $2,000.00.$49.99Current price is: $49.99.

Elise EA Source Code offers complete MQL4/MQL5 source code access with grid-martingale automation. Full transparency for advanced MT4/MT5 traders.

Introducing Elise EA Source Code

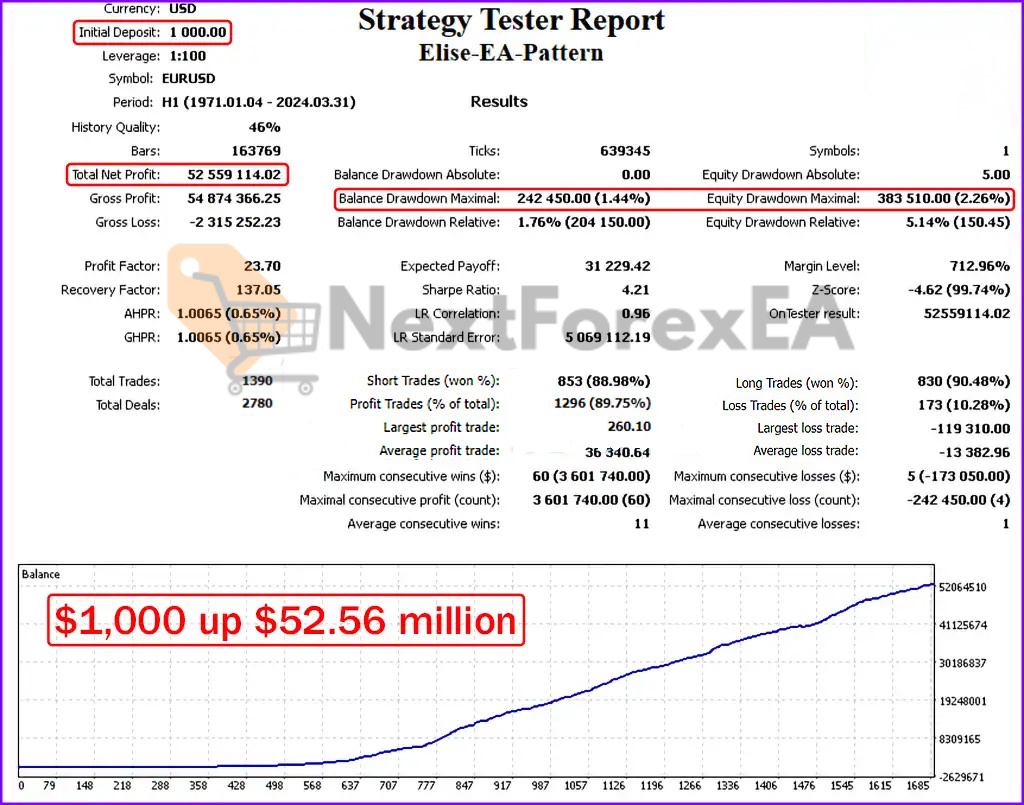

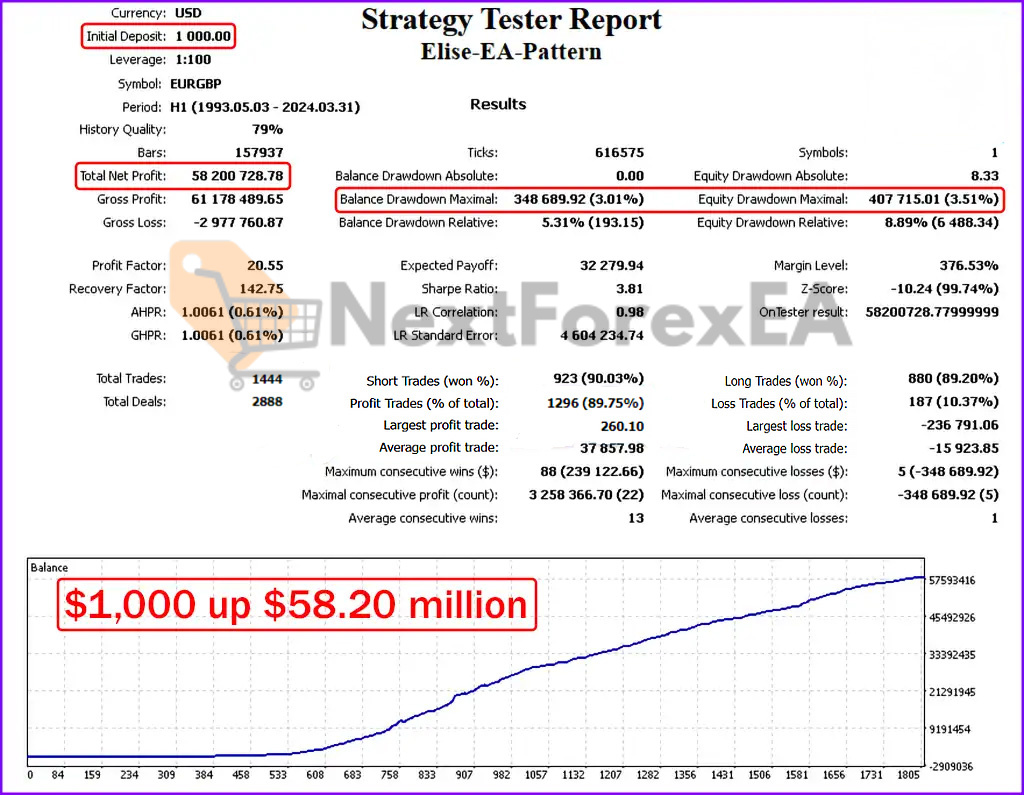

Elise EA Source Code delivers a comprehensive automated trading ecosystem featuring grid-martingale strategies, scalping logic, and gold optimization with complete MQL4/MQL5 source code access across MT4/MT5 platforms. Backtests spanning 30-50 years demonstrate exceptional profit factors of 20-23 across major currency pairs, though with inherent grid strategy risks. The complete transparency through source code access makes this an educational powerhouse for serious algorithmic trading development.

Key Findings

• Multi-Strategy Architecture: Comprehensive suite including standard grid EA, gold-specific optimization (XAUUSD), and pattern-recognition variants – each tailored for specific market conditions and asset characteristics

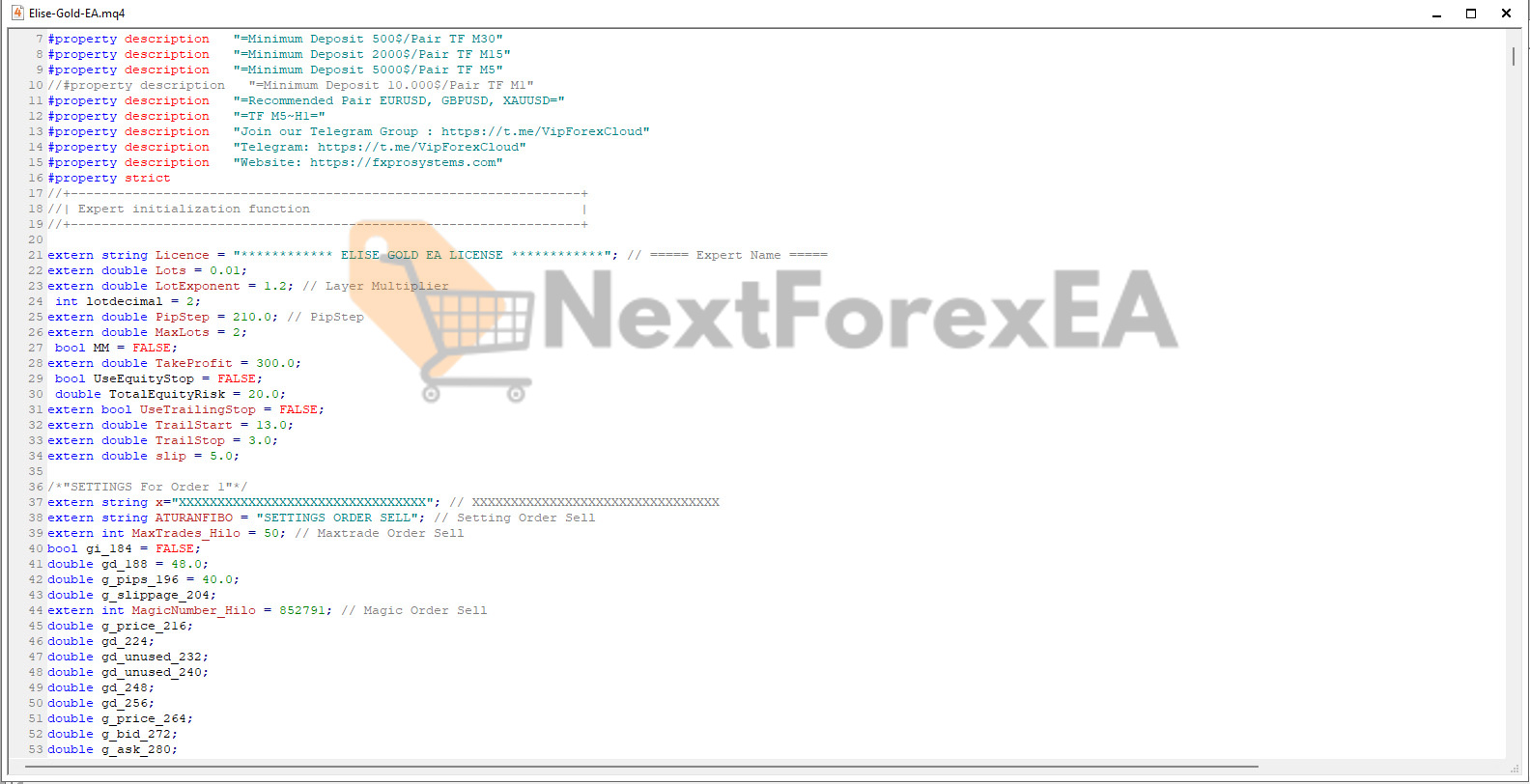

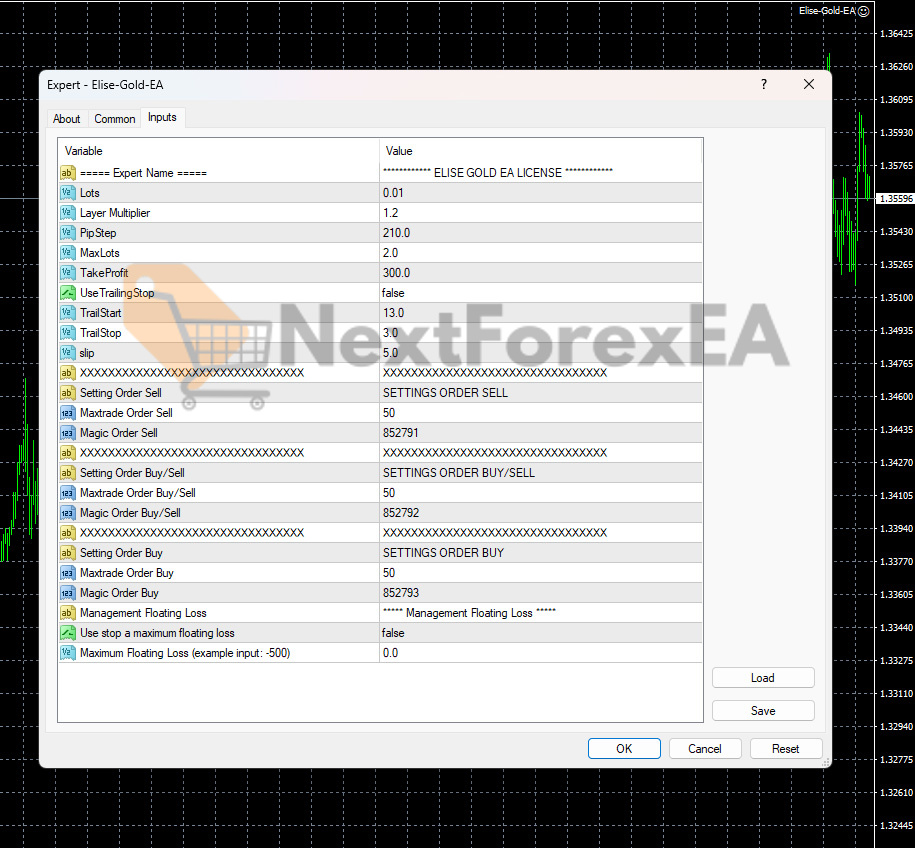

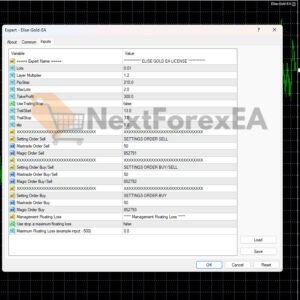

• Grid-Martingale Implementation: Core strategy places orders at systematic PipStep intervals (210 pips default for gold), employs controlled lot multiplication (LotExponent 1.2), and targets accumulated profits during market reversals

• Sophisticated Order Management: Utilizes separate magic numbers (852791-852793) for Buy/Sell operations, implements MaxLots caps (default 2.0), includes floating loss stops, and provides trailing stop functionality

• Complete Code Transparency: Full MQL4/MQL5 source code included – exceptional educational resource enabling strategy analysis, parameter understanding, and custom development insights

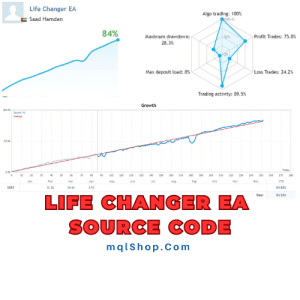

• Extensive Backtest Coverage: EURUSD (1971-2024) shows 52.6M profit with 23.70 profit factor, EURGBP achieves 58.2M over 31 years – however, low history quality (46-79%) raises data reliability concerns

• Flexible Configuration Options: Comprehensive parameter framework covering lot sizing, risk management, execution controls, and multiple exit strategies – requires expertise to optimize effectively

• Fundamental Strategy Risk: Grid-martingale approach vulnerable to sustained trending markets that can generate exponential losses despite built-in risk controls and position limits

Recommendations for using Elise EA Source Code

• Platform Requirements: MetaTrader 4 (MT4) or MetaTrader 5 (MT5) with dedicated versions for each platform providing identical functionality and parameter sets

• Recommended Pairs: EURGBP, USDJPY, EURUSD extensively tested; Gold version targets EURUSD, GBPUSD – avoid volatile exotics and news-sensitive pairs during major events

• Account Specifications: ECN/RAW accounts mandatory for competitive spreads – grid profitability directly correlates with execution costs and minimal slippage requirements

• Timeframe Selection: H1 primary backtest timeframe with M15-H1 range supported – shorter timeframes increase execution frequency but amplify broker spread impact

• Leverage Considerations: 1:100 utilized in testing – higher leverage exponentially increases both profit potential and catastrophic loss risk during adverse trending periods

• Deposit Requirements: $500 minimum for M15/M30, $1000 for M1 strategies – substantially higher capital recommended for proper grid funding and drawdown management

• Infrastructure Setup: VPS hosting essential for consistent execution, low latency critical for scalping components, and 24/7 operation ensuring grid management continuity

Review of Elise EA Source Code

Elise EA Source Code excels as both trading tool and educational resource, providing sophisticated grid-martingale automation with complete source code transparency. The extensive backtest history shows compelling profit factors, but concerning data quality issues and inherent martingale risks demand careful evaluation. Comprehensive parameter control enables precise customization but requires deep understanding of grid mechanics to avoid catastrophic scenarios. Ideal for advanced traders seeking strategy transparency and development insights; beginners must avoid due to complex exponential risk profiles.

Historical Performance Summary:

• EURUSD (53 years): 23.70 profit factor, 4.21 Sharpe ratio, 2.26% max equity drawdown

• EURGBP (31 years): 20.55 profit factor, 142.75 recovery factor, 5.31% max balance drawdown

• USDJPY (53 years): 21.02 profit factor, 3.45 Sharpe ratio, 0.97% balance drawdown

• Consistent high-performance metrics across decades, but 46-79% history quality raises backtest reliability concerns

Is Elise EA Source Code the Right Choice For You?

• Unparalleled Transparency: Complete source code access enables full strategy understanding and custom modifications – requires programming expertise to leverage effectively and understand risk management implications

• Educational Investment: Working example of professional-grade multi-strategy EA with decades of performance data – steep learning curve but invaluable for algorithmic trading development

• Multi-Asset Capability: Covers major forex pairs plus gold-specific optimization with dedicated parameter sets – each requires individual risk assessment and optimization approach

• Proven Performance Framework: Consistent profit factors across multiple decades and currency pairs – low backtest quality and potential over-optimization require independent validation testing

• Advanced Risk Architecture: Comprehensive position sizing, exposure limits, and exit controls with full customization – demands thorough grid-martingale understanding to prevent exponential loss escalation

Final Verdict

Elise EA Source Code represents a premium educational and trading resource combining sophisticated automation with complete strategy transparency, but demands advanced expertise in both trading and programming. Exceptional choice for experienced traders seeking comprehensive strategy control and development insights; absolutely unsuitable for beginners due to complex martingale dynamics and extensive parameter optimization requirements.

Elise EA Source Code Download Contents:

- Link download experts:

- Elise EA Source Code.mq4

- Elise EA Source Code.mq5

Be the first to review “Elise EA Source Code MQ4 & MQ5” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

SOURCE CODE

SOURCE CODE

SOURCE CODE

SOURCE CODE

FOREX ROBOT

SOURCE CODE

SOURCE CODE

Reviews

There are no reviews yet.