Forex Vzlomshik Pro EA MT4 V1.1 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

Forex Vzlomshik Pro EA MT4 combines 3 automated trading strategies with verified 32.89% live gains. Advanced grid system for experienced traders.

Introducing Forex Vzlomshik Pro EA

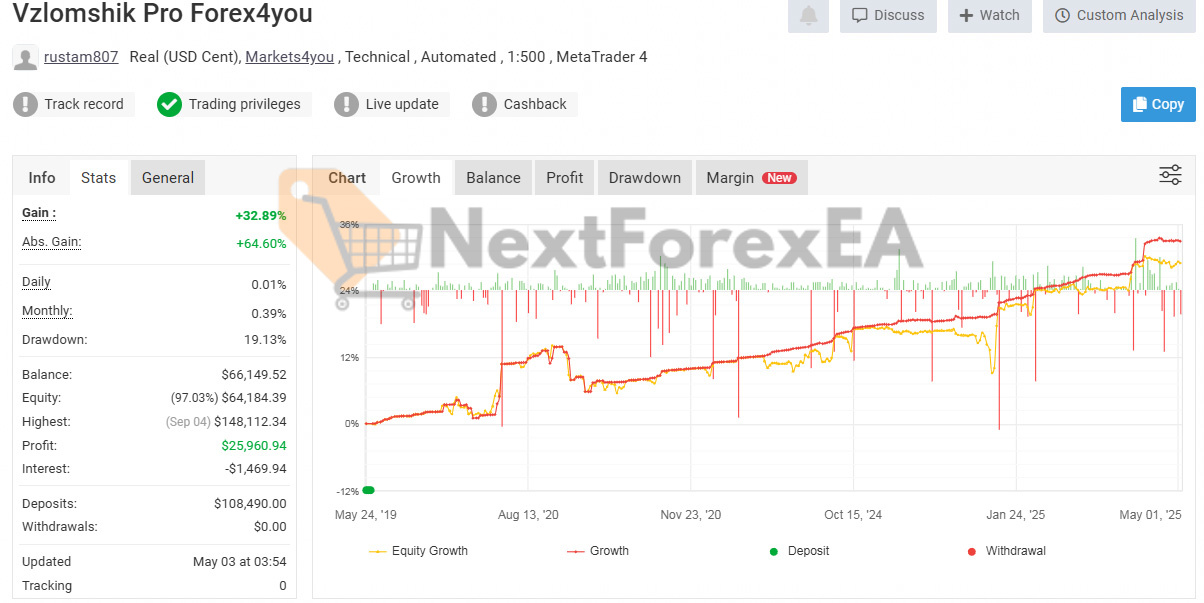

Forex Vzlomshik Pro EA revolutionizes automated trading through its groundbreaking multi-strategy engine, simultaneously operating three distinct trading systems including grid recovery, scalping, and profit-target methodologies. Live verified accounts achieved 32.89% gains while managing drawdown at 19.13% across extended market conditions. This MetaTrader 4 system combines advanced grid mechanics with comprehensive customization options for experienced traders.

Key Findings

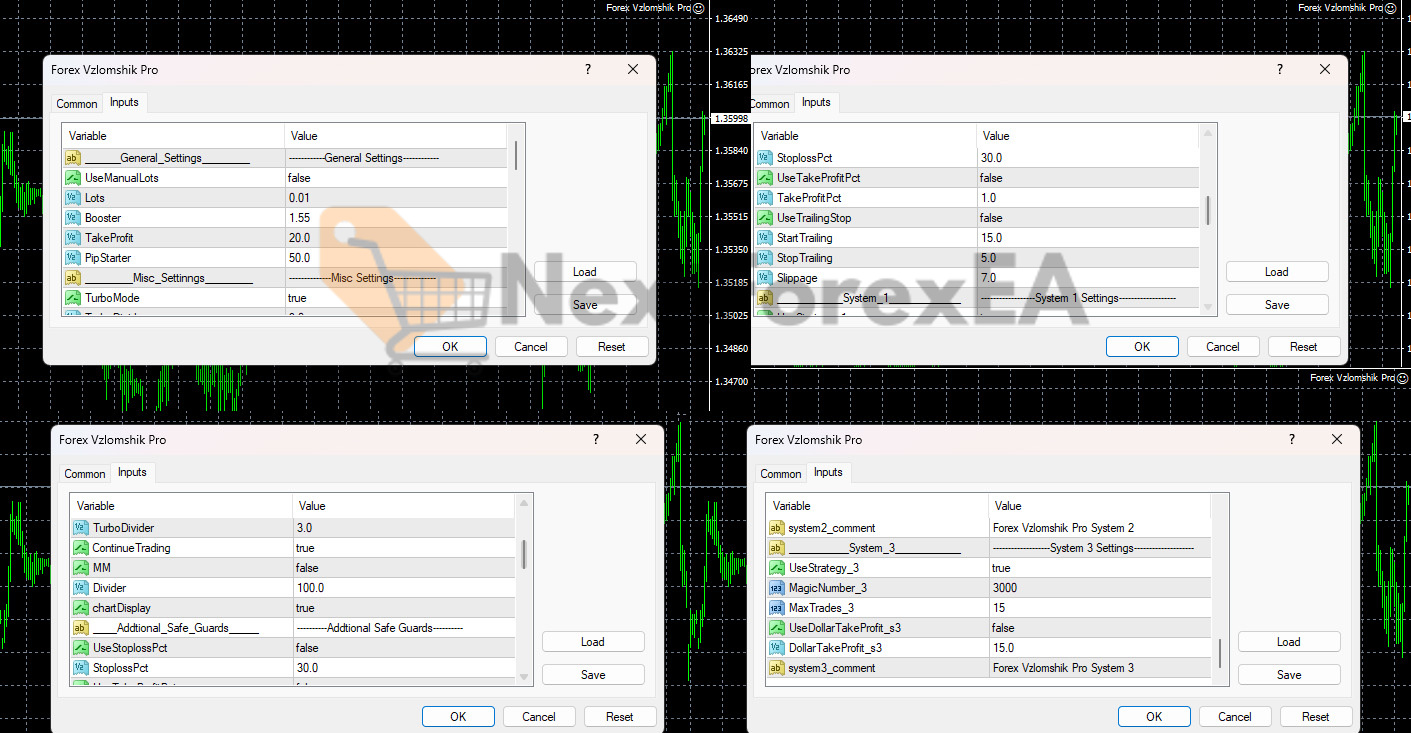

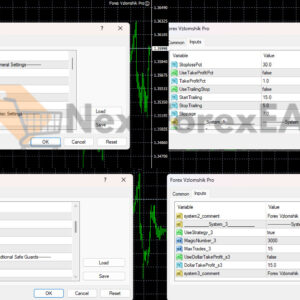

• Overview: Sophisticated automated framework managing three parallel trading strategies via independent Magic Numbers, featuring configurable grid intervals (PipStarter), lot multiplication (Booster), aggressive TurboMode entries, and flexible profit targeting systems

• Trading Strategy: Grid-based recovery methodology initiates trades then systematically opens additional positions at predetermined intervals when markets move unfavorably, applying progressive lot sizing to achieve favorable average entry prices before closing entire position groups at cumulative profit thresholds

• Algorithm Components: Non-indicator system leveraging distance-based position placement, configurable multiplication factors, multiple profit target approaches (fixed pips, percentage-based, dollar targets), trailing stop capabilities, and independent system management through Magic Number segregation

• Key Benefits with Trade-offs:

- Multi-system diversification enables simultaneous strategy testing and risk distribution, but requires advanced parameter coordination and ongoing optimization expertise

- Automated position management eliminates emotional trading decisions during drawdown periods, though grid approach inherently creates substantial equity exposure risks

- Flexible profit targeting and risk controls provide optimization opportunities, but incorrect parameter selection can rapidly lead to account failure

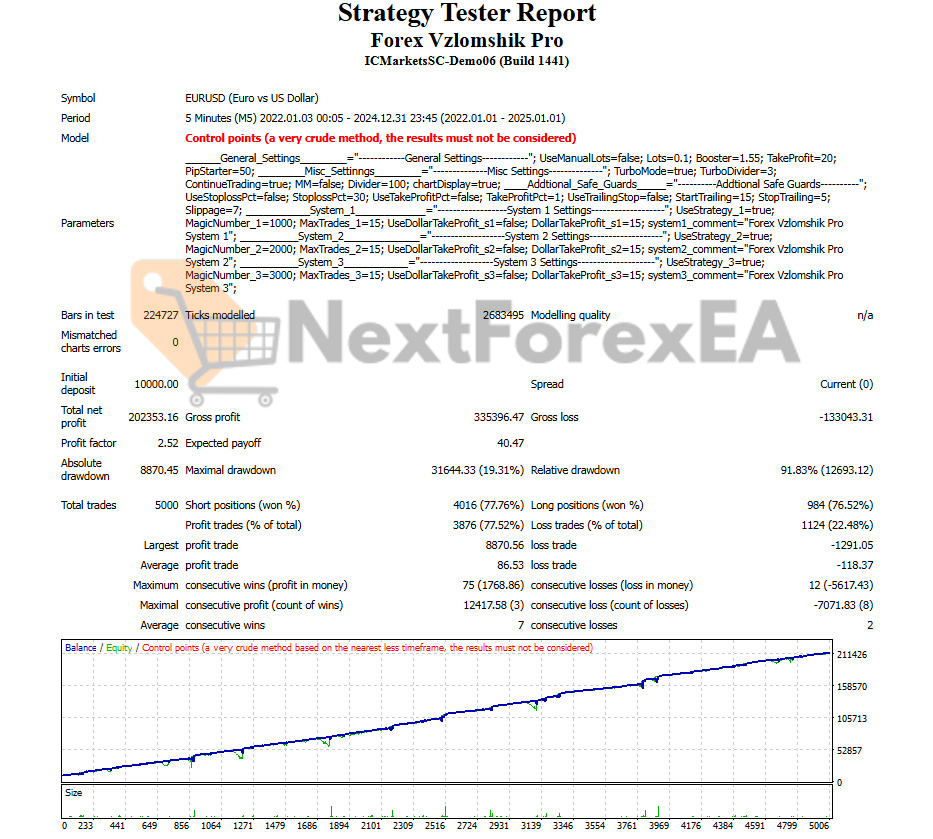

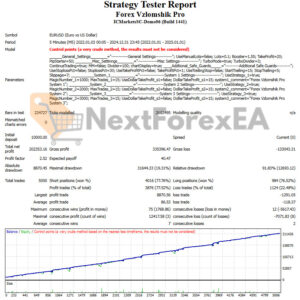

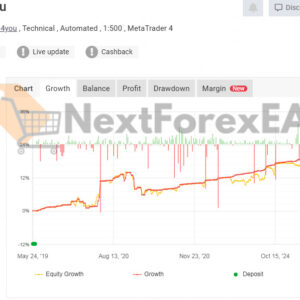

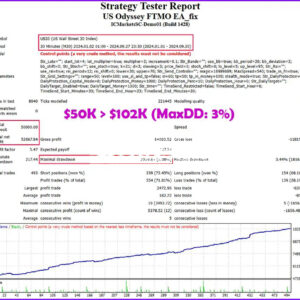

• Performance Data: Three-year backtesting demonstrates 2,025% returns and 2.52 profit factor, but accompanied by extreme 91.83% relative drawdown exposure. Live Myfxbook accounts show sustainable 32.89% gains with more manageable 19.13% maximum drawdown reflecting realistic market conditions

• Primary Risks: Grid recovery strategy exponentially increases position sizes during sustained adverse trends, potentially triggering margin calls. Performance heavily depends on parameter optimization as configurations effective in ranging markets may prove catastrophic during directional price movements

Recommendations for using Forex Vzlomshik Pro EA

• Trading Platform: MetaTrader 4 (MT4) exclusive compatibility

• Pairs: EURUSD primary recommendation with included preset files – focus on major pairs for optimal spread conditions and reduced volatility impact on grid strategies

• Supported Accounts: ECN accounts strongly preferred for spread advantages benefiting grid economics, though Standard accounts compatible with adjusted parameters

• Timeframe: H1 timeframe recommended per included EURUSD_H1.set file, with M5 successfully backtested – higher timeframes may reduce market noise interference

• Trading Time: Full 24/5 market coverage without session-specific limitations

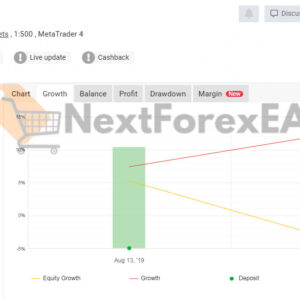

• Leverage: 1:500 utilized in verified live accounts – high leverage amplifies both profit potential and loss exposure, requiring strict broker margin requirement verification and continuous monitoring

• Minimum Deposit: $10,000 minimum based on backtest parameters, though significantly higher capital strongly advised considering grid strategy’s capital requirements and historical 91.83% maximum drawdown exposure

Review of Forex Vzlomshik Pro EA

Forex Vzlomshik Pro EA delivers advanced multi-strategy automation with transparent live performance verification, but demands expert-level risk management understanding due to grid trading’s amplified capital exposure characteristics. Best suited for experienced traders with substantial capital reserves.

Extended Backtest Analysis: Three-year comprehensive testing showing 2,025% profit growth and 2.52 profit factor, but concerning 91.83% relative drawdown indicates severe equity risk exposure

Live Performance Verification: Myfxbook-verified account demonstrates 32.89% real-market gains with 19.13% maximum drawdown, providing realistic performance expectations versus backtest projections

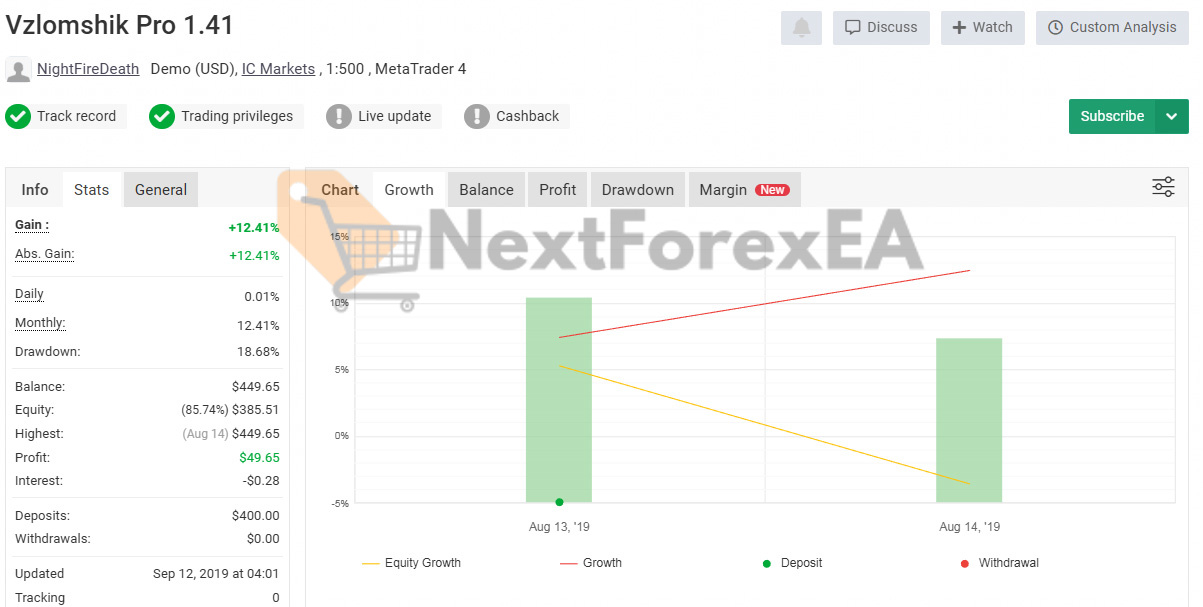

Demo Account Consistency: 12.41% returns with 18.68% drawdown maintaining consistent risk-reward profile across different account environments

Is Forex Vzlomshik Pro EA the Right Choice For You?

• Multi-Strategy Innovation: Three independent systems enable sophisticated diversification and parallel strategy testing, though operational complexity requires advanced parameter management skills and continuous optimization attention

• Verified Performance Transparency: Live Myfxbook account verification provides real-market validation unlike many backtest-only systems, but actual returns significantly more modest than theoretical projections

• Professional Grid Automation: Systematic recovery approach eliminates emotional decision-making during adverse market phases, however grid methodology fundamentally amplifies capital exposure during sustained directional movements

• Operational Reliability: ContinueTrading feature ensures seamless operation through platform restarts and interruptions, though maintaining adequate margin levels remains critical user responsibility

• Integrated Risk Management: Built-in percentage stop losses and automated money management provide protection layers, but grid strategy nature demands substantial capital reserves beyond conventional EA requirements

Final Verdict

Forex Vzlomshik Pro EA provides sophisticated multi-strategy automation with credible live performance validation, but requires advanced trading knowledge and substantial capital due to grid methodology’s high-drawdown nature. Suitable exclusively for experienced traders; beginners should avoid due to complex risk management demands.

Forex Vzlomshik Pro EA MT4 Download Contents:

- Link download experts:

- Forex Vzlomshik Pro EA MT4.ex4

- Presets:

- EURUSD_H1.set

Be the first to review “Forex Vzlomshik Pro EA MT4 V1.1 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

SOURCE CODE

FOREX ROBOT

SOURCE CODE

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.