WayGrow EA MT4 V1.8 with Setfiles

$899.00 Original price was: $899.00.$39.99Current price is: $39.99.

WayGrow EA MT4 delivers advanced automated trading with dynamic money management and grid strategy. Designed for expert traders seeking rapid growth.

Introducing WayGrow EA MT4

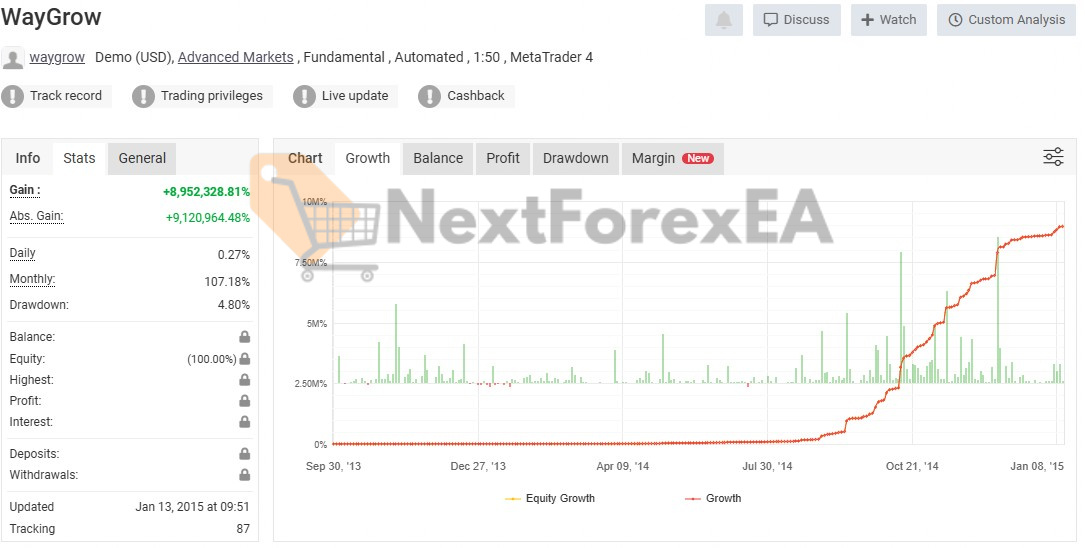

WayGrow EA distinguishes itself through highly aggressive automated trading combined with extensive customization options specifically designed for advanced traders seeking rapid account growth. Live results claim extraordinary gains exceeding 8 million percent, though data reliability raises significant concerns.

Key Findings

• Overview: Advanced MT4 automated system featuring dynamic money management, customizable moving average logic, and comprehensive risk controls designed for high-frequency trading across major forex and commodity markets

• Trading Strategy: High-frequency grid-influenced approach utilizing weighted Moving Average triggers combined with systematic position spacing – employs mathematical progression for position size management

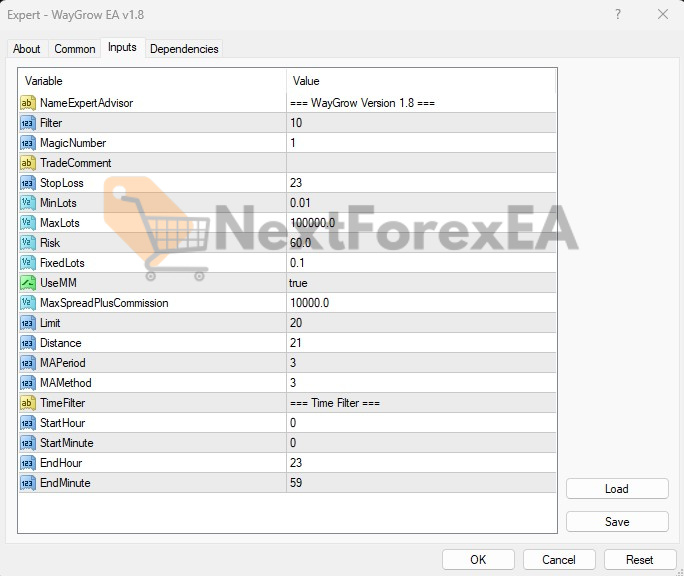

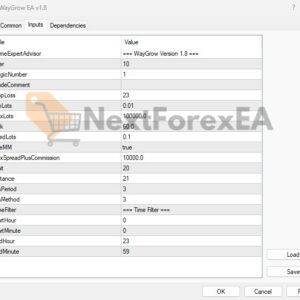

• Technical Framework: Core system integrates fast MA calculations (customizable period 3, method 0) with trade spacing controls (Limit 20, Distance 21 pips) while applying 60% default risk allocation through dynamic lot sizing

• Operational Advantages: Eliminates emotional trading through complete automation, provides 24/5 market coverage with time filtering options, offers institutional-level parameter customization – requires substantial expertise and carries extreme capital risk

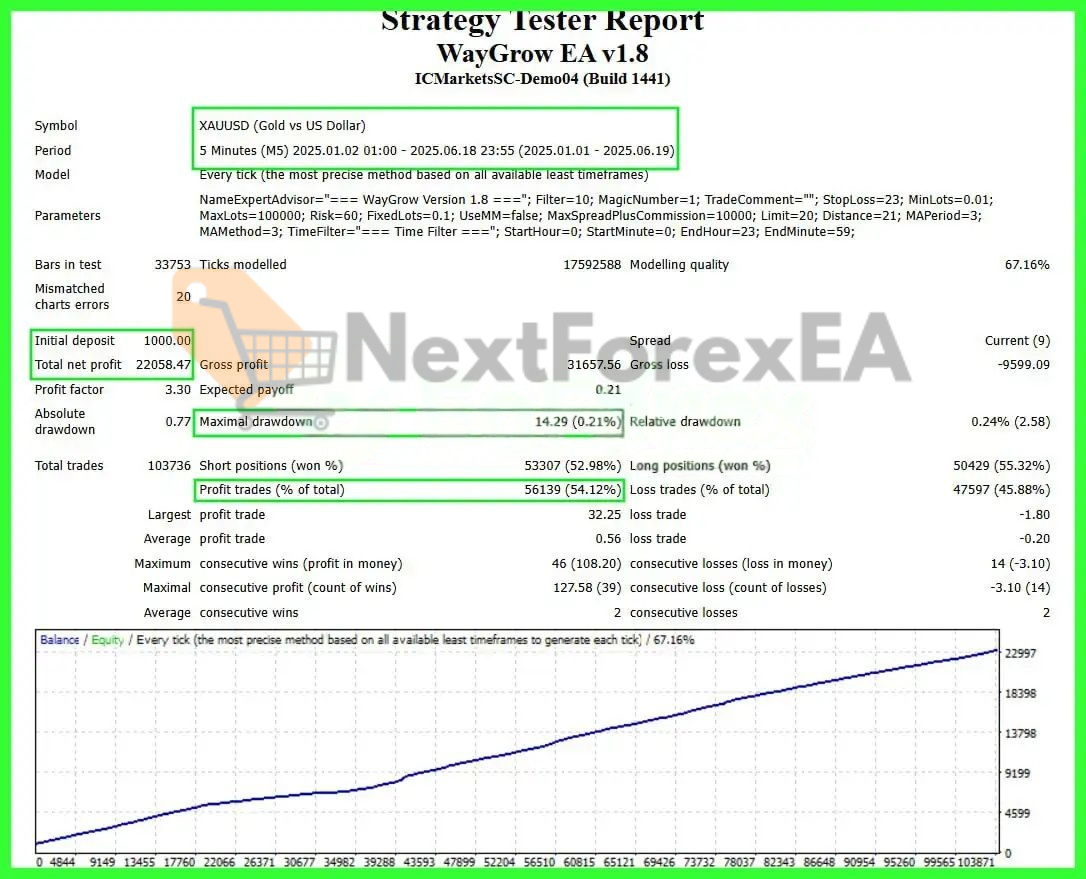

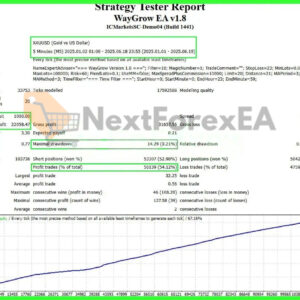

• Documented Performance: Backtest demonstrates 2,205% profit with 103,736 trades over 6 months achieving 3.30 profit factor – significant concerns exist regarding 67.16% modeling quality and result reproducibility

• Critical Risk Factors: Default 60% risk setting creates catastrophic loss potential, grid/martingale methodology vulnerable to trending markets, conflicting performance data timeline undermines credibility assessment

Recommendations for using WayGrow EA MT4

• Trading Platform: MetaTrader 4 (MT4) exclusively supported

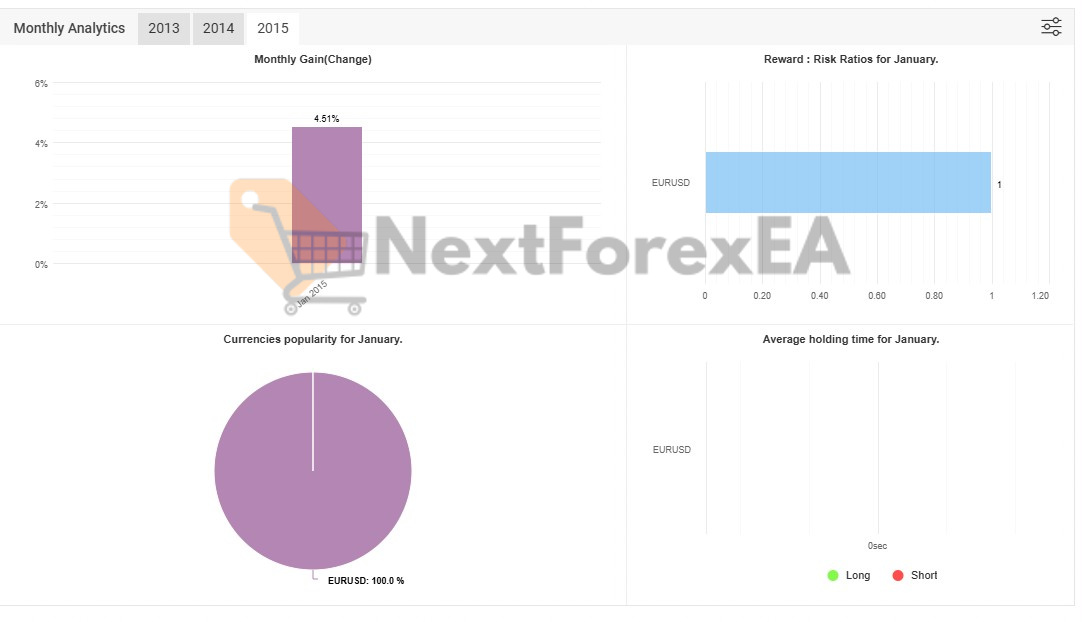

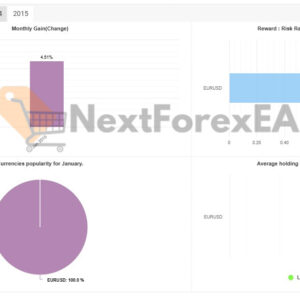

• Pairs: XAUUSD extensively tested, EURUSD documented – gold trading introduces additional volatility requiring enhanced risk monitoring

• Supported Accounts: Any MT4 compatible broker – ECN accounts recommended for optimal high-frequency execution

• Timeframe: M5 primary testing, M1 preset configurations – shorter timeframes increase execution dependency and slippage risks

• Trading Time: Full 24/5 automation available with customizable restrictions – major news avoidance strongly recommended

• Leverage: Conservative leverage essential – grid strategies compound leverage risks dramatically during drawdown periods

• Minimum Deposit: Substantial capital required well above stated minimums – aggressive risk parameters demand significant account protection buffer

Review of WayGrow EA MT4

WayGrow EA addresses automated trading needs through sophisticated high-frequency execution but introduces extreme risk via aggressive defaults and grid-based recovery. Exclusively suitable for expert algorithmic traders with comprehensive risk management experience.

Backtest Analysis: Outstanding 2,205% returns over 6 months with minimal 0.21% drawdown, however limited modeling quality (67.16%) suggests potential over-optimization issues

Live Track Record: Historical Myfxbook shows exceptional multi-million percent gains but 2013-2015 timeline creates serious credibility gaps for current market conditions

Configuration Complexity: 15+ parameter inputs provide extensive strategy control but require advanced optimization knowledge to prevent dangerous over-fitting

Is WayGrow EA MT4 the Right Choice For You?

• Complete Automation Solution: Handles all aspects of trade management including entries, sizing, and risk control – eliminates manual intervention requirements but demands reliable technology infrastructure and continuous monitoring

• Mathematical Trading Approach: Systematic moving average entries combined with algorithmic position management remove discretionary elements – requires comprehensive understanding of grid system mathematics and failure scenarios

• Aggressive Growth Targeting: Specifically designed for rapid account expansion through high-frequency trading volume – balanced against proportional risk of rapid capital depletion during market reversals

• Professional-Grade Customization: Institutional-level parameter control enables strategy adaptation across different market phases – demands extensive backtesting capabilities and deep risk management expertise

• Round-the-Clock Operation: Maximizes profit opportunities through continuous market participation – introduces extended exposure periods including gap risks and system failure vulnerabilities

Final Verdict

WayGrow EA provides powerful automation with exceptional backtest performance but carries extreme risk through aggressive parameters and grid-based methodology. Appropriate exclusively for expert traders with substantial risk capital and comprehensive algorithmic trading experience.

WayGrow EA MT4 Download Contents:

- Link download experts:

- WayGrow EA MT4.ex4

- Presets:

- GOLD M1.set

Be the first to review “WayGrow EA MT4 V1.8 with Setfiles” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

SOURCE CODE

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

FOREX ROBOT

Reviews

There are no reviews yet.